Talk of tax:

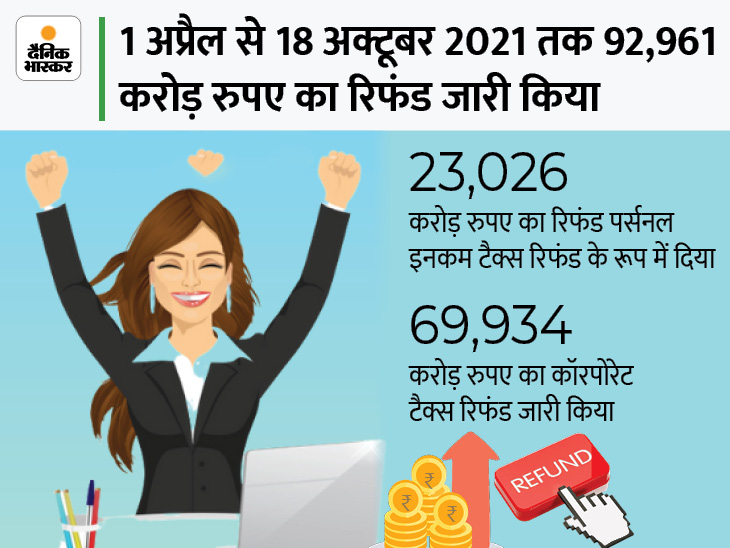

1.69 lakh taxpayers have been given corporate tax refunds of Rs 69,934 crore

From April 1, 2021 to October 18, 2021, the Income Tax Department has given refunds of Rs 92,961 crore to 63.23 lakh taxpayers. Out of this, refunds of Rs 23,026 crore have been given to 61.53 lakh taxpayers in the form of personal income tax refunds.

also read

Top 10 best antivirus app for android

Here's how to check your refund status

Go to the taxpayers tin.tin.nsdl.com website.

To know the refund status, it is necessary to fill in the two information given here. Fill in the pen number and the year in which the refund is due.

Now fill in the captcha code given below.

After that, the status will come as soon as you click on Proceed.

Check this out on the new income tax portal

Go to the Income Tax website www.incometax.gov.in and login to the account by entering your pen, user ID and password.

After logging in, click on the e-file option.

Under the e-File option, select Income Tax Return and then click on View Filed Return option.

Then check the latest ITR you have filed. Select the View Details option. Once selected, the status of the ITR you have filed will appear.

It will also show you the date of declaration of tax refund, amount of refund and any clearance date of this year's refund.

You can also check the refund status from the Income Tax Department site

First go to www.incometaxindiaefiling.gov.in website.

Login to your account by filling in details like pen, password and captcha code. Click on 'Review Returns / Forms'.

ALSO READ

Mukhyamantri ma amrutam yojana scheme details and hospital list

Select 'Income Tax Return' from the drop down menu. Select the assessment year for which you want to check the income tax refund status.

Then click on your acknowledgment number i.e. hyperlink.

A pop-up will appear on your screen showing the timeline of the return filing.

Such as when your ITR was filed and verified, processing completion date, refund issue date, etc.

ITR required to file tax refund

If you want to claim a tax refund, you need to file an ITR. When you file an ITR, the Income Tax Department assesses it. If a refund is made, it will be credited to a direct bank account.

What is a refund?

The company deducts a portion of the tax from the salary and credits it to the government account while paying its employees for the whole year. The employee files an income tax return at the end of the year. In which he states how much he has to pay as tax. If the actual amount is less than the tax amount, the remaining amount is returned to the employee in the form of a refund.

No comments:

Post a Comment